Managing payroll for a global workforce can be a complex and challenging task for businesses. Different countries have different payroll regulations, tax laws, and compliance requirements, making it essential for businesses to have a robust payroll system in place. In this article, we will discuss the four key payroll management software solutions that businesses can leverage to manage their international and global payroll effectively.

Payroll Management Software

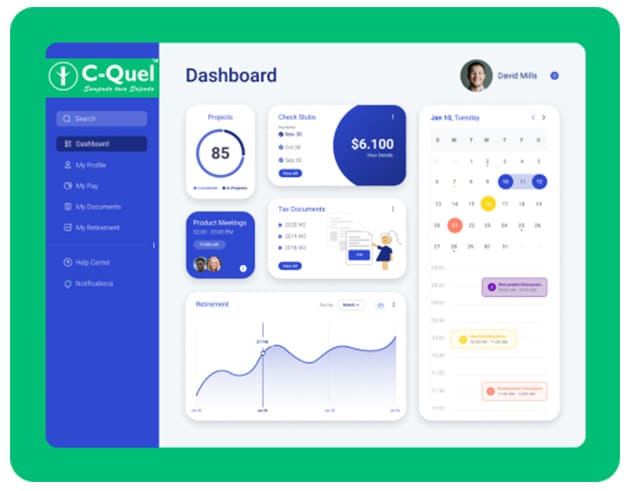

Payroll Management Software is a digital solution that can help businesses manage their payroll processes efficiently. This software is designed to automate payroll processes, including tax calculations, deductions, and salary payments. With Payroll Management Software, businesses can ensure compliance with local and international payroll regulations, reduce errors, and improve overall efficiency.

This Management Software also offers features such as online payslips, employee self-service portals, and real-time reporting. This software can also integrate with other HR systems, such as HRMS payroll software, to provide a seamless experience for businesses.

HRMS Payroll Software

HRMS Payroll Software is an integrated solution that combines payroll and human resource management processes. This software can help businesses to manage their payroll, benefits, and employee data in a centralized system. HRMS Payroll Software can also help businesses to streamline HR processes such as recruitment, onboarding, and performance management.

With HRMS Payroll Software, businesses can manage their payroll processes more efficiently, reduce manual errors, and ensure compliance with local and international payroll regulations. This software can also provide insights into employee data, such as leave balances, attendance, and performance, to help businesses make data-driven decisions.

Employee Payroll Management System

Employee Payroll Management System is a digital solution that can help businesses to manage their payroll processes and employee data effectively. This software is designed to automate payroll processes such as tax calculations, deductions, and salary payments. Employee Payroll Management System can also provide features such as online payslips, employee self-service portals, and real-time reporting.

This software can also help businesses to manage employee data such as attendance, leave balances, and performance. Employee Payroll Management System can help businesses to ensure compliance with local and international payroll regulations, reduce manual errors, and improve overall efficiency.

Attendance and Payroll Software

Attendance and Payroll Software is a digital solution that can help businesses to manage their payroll and attendance processes effectively. This software is designed to automate payroll processes such as tax calculations, deductions, and salary payments. Attendance and Payroll Software can also provide features such as online payslips, employee self-service portals, and real-time reporting.

This software can also help businesses to manage attendance data, such as clock-ins and clock-outs, and provide insights into employee attendance patterns. Attendance and Payroll Software can help businesses to ensure compliance with local and international payroll regulations, reduce manual errors, and improve overall efficiency.

Conclusion

Managing payroll for a global workforce can be a complex and challenging task for businesses. However, with the right payroll management software solutions, businesses can manage their payroll processes efficiently, reduce manual errors, and ensure compliance with local and international payroll regulations. Payroll Management Software, HRMS Payroll Software, Employee Payroll Management System, and Attendance and Payroll Software are just a few examples of digital tools that businesses can leverage to manage their international and global payroll effectively.